For more information, feel free to reach out at

647 901-7948

info@modomortgages.ca

Book a call

First Time Home Buyer Mohamed Mahmoud 31 Mar

For more information, feel free to reach out at

647 901-7948

info@modomortgages.ca

Book a call

First Time Home Buyer Mohamed Mahmoud 10 Mar

First Time Home Buyer Mohamed Mahmoud 3 Mar

Did you know you can utilize up to $35,000 in RRSP for your down payment if you’re a first time buyer?

First Time Home Buyer Mohamed Mahmoud 23 Feb

One important note to keep in mind if you’re buying a condo apartment or townhouse.

Always make sure to review the strata certificate before putting an offer. This will show details pertaining to maintenance fees, active law suits, reserve funds, and any assessments.

Most lenders will not lend on buildings with active lawsuits, especially if the reserve funds and insurance don’t cover the amount.

Keep this in mind if you’re on the market for a condo

Feel free to reach out for more details

647 901-7948

info@modomortgages.ca

First Time Home Buyer Mohamed Mahmoud 9 Feb

Keep your credit score healthy by keeping credit cards as low as possible, paying bills on time and keeping your current credit cards open.

First Time Home Buyer Mohamed Mahmoud 3 Feb

Now that you have finished signing your mortgage paperwork and getting the keys to your first home, there are a few things to keep in mind after you buy to protect your investment and ensure future financial success!

1) Maintaining your home and protecting your investment.

2) Make your mortgage payments on time

3) Plan for the costs of operating a home

4) Live within your budget

5) Save for emergencies

First Time Home Buyer Mohamed Mahmoud 19 Jan

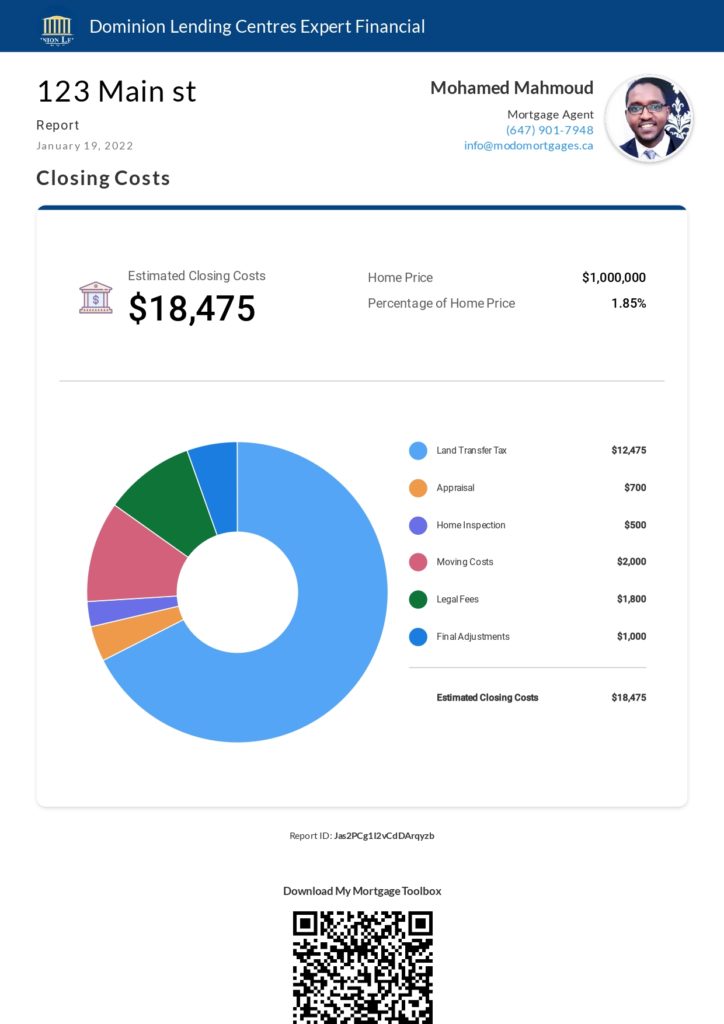

I’ve put together an estimate of different costs associated with buying a home, other than the down payment.

This is what’s known as ”closing costs”, and the lender will want to make sure you have a minimum amount available for closing costs over and above the required down payment.

Usually a minimum of 1.5% of the purchase price needs to be available and proven to the lender.

Please note this is only an estimate, and the amount will be more or less depending on several factors.

Here is a link to learn more about your own Closing Costs.

https://dlcapp.ca/app/mohamed-mahmoud/report/33O-7jPooDIvXWdgCzSb?lang=en-ca

First Time Home Buyer Mohamed Mahmoud 5 Jan

GST/HST:

This tax is only charged on brand new homes or substantially renovated homes. If a property is valued at $450,000 or less, and will be your primary residence, you may be eligible for a partial rebate but certain conditions may apply.

Contact your lawyer/ notary for more detailed information.

First Time Home Buyer Mohamed Mahmoud 29 Dec

You will hear the word ”insurance” more than once!

To avoid confusion, here are the types of insurance you might encounter in your home buying journey. Note that not all of them are mandatory depending on specific circumstances:

1) Mortgage Default Insurance: This is mandatory if you’re paying less than 20% down payment, and protects the lender in case of default on Mortgage payments.

2) Homeowner (fire) insurance: This is usually required by the lenders and provides coverage for loss or damage to a structure damaged or destroyed in a fire.

3) Mortgage Protection Insurance: This is optional life and/or disability insurance that pays out the full Mortgage balance in case of death, or takes care of the Mortgage payments while the homeowner is disabled.

4) Title Insurance: Some lenders might require you obtain title insurance. The policy provides coverage against losses due to title defects, even if the defects existed before you purchased your home

First Time Home Buyer Mohamed Mahmoud 15 Dec

Mortgage default insurance is designed to protect the lenders from any losses should there ever be a foreclosure.

The borrower is required to pay for Mortgage default insurance whenever the down payment is less than 20%.

The premium is usually added on to your Mortgage balance and incorporated into your Mortgage payments