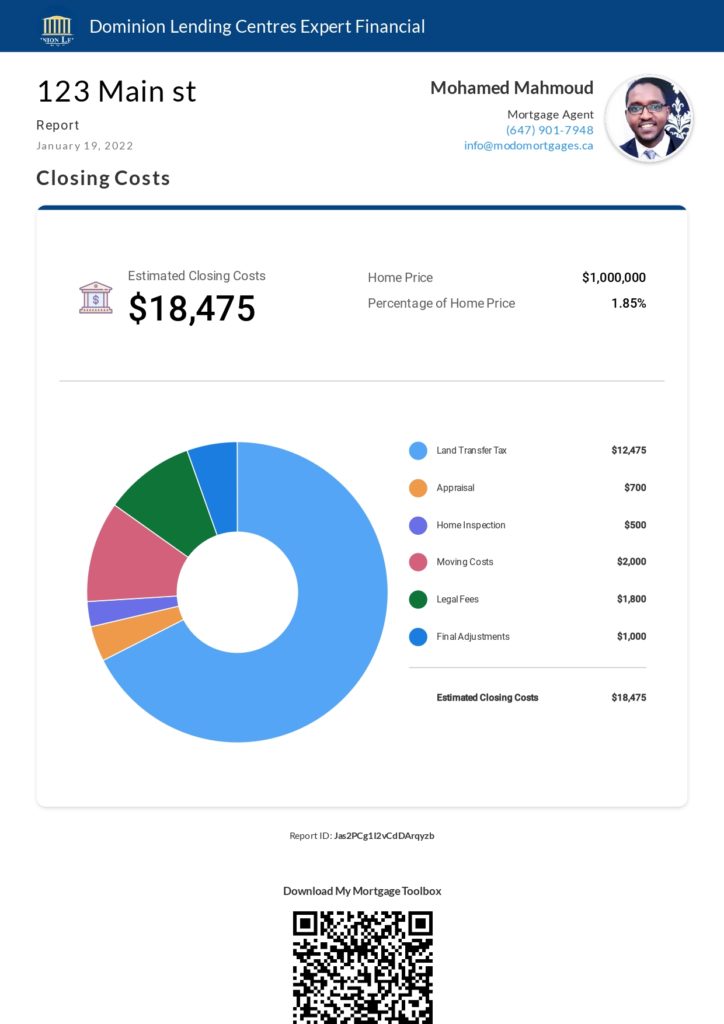

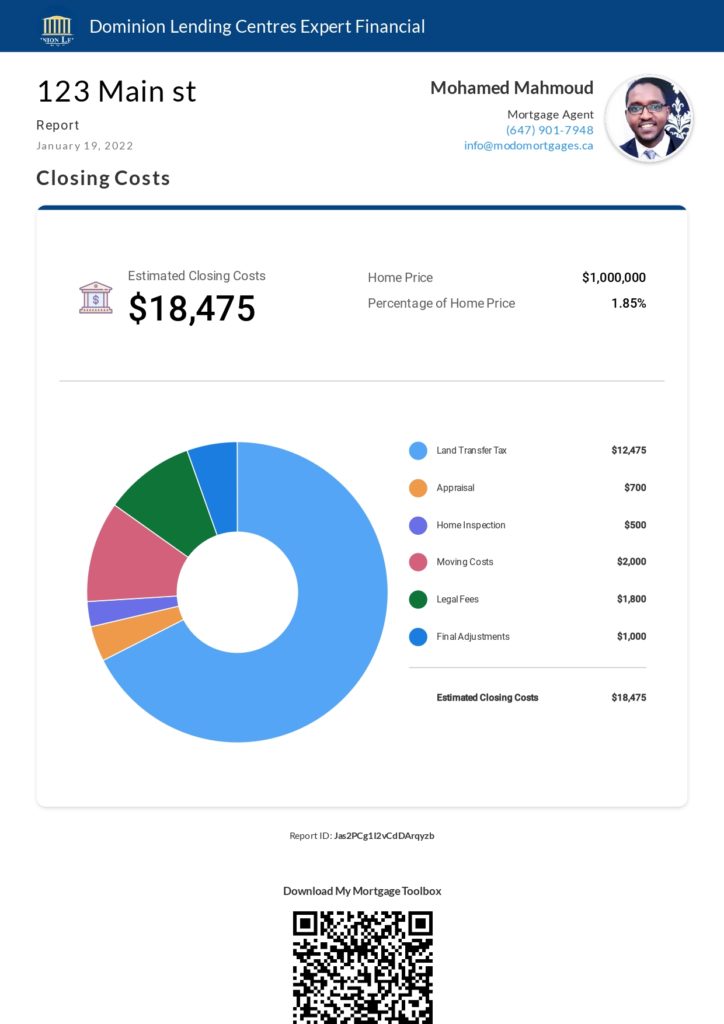

I’ve put together an estimate of different costs associated with buying a home, other than the down payment.

This is what’s known as ”closing costs”, and the lender will want to make sure you have a minimum amount available for closing costs over and above the required down payment.

Usually a minimum of 1.5% of the purchase price needs to be available and proven to the lender.

Please note this is only an estimate, and the amount will be more or less depending on several factors.

Here is a link to learn more about your own Closing Costs.

https://dlcapp.ca/app/mohamed-mahmoud/report/33O-7jPooDIvXWdgCzSb?lang=en-ca

Life I

Life I