Bond yields and commodity prices surged around the world yesterday as confidence in a vaccine-induced rebound increases.

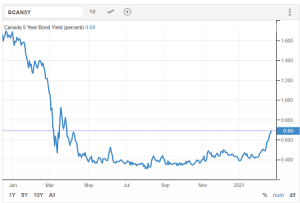

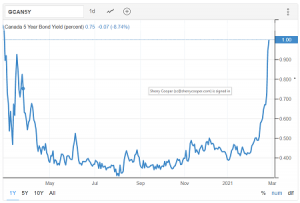

Canadian 5-Year Bond Yield Surges

In an unprecedented move, bond yields are spiking around the world. Yields globally are now at levels last seen before the coronavirus spread worldwide. At the same time, commodity prices are surging, including energy, metals and minerals, agricultural products and lumber. The Biden administration’s $1.9 trillion stimulus package has triggered fears that if the US economy returns to full employment too quickly, inflation might be the result.

Central banks have attempted to soothe markets, with European Central Bank chief economist Philip Lane saying the institution can buy bonds flexibly. Fed Chair Jerome Powell called the recent run-up in yields “a statement of confidence” in the economic outlook. Bank of Canada Governor Tiff Macklem told us earlier this week that it’s a long road to recovery for the Canadian economy. The Bank of Canada will continue to provide support every step of the way. Many Bay Street economists took this to mean that he reinforced the BoC’s commitment to keeping the policy rate at its effective lower bound of 25 bps until sometime in 2023.

These global developments have sideswiped Canada. On Tuesday, I warned that the 5-year government bond yield had risen 27 bps to 0.69% since the beginning of this month, shown in the first chart below. This morning, the rise has become exponential, hitting 1.00%, shown in the second chart.

Keep in mind that Canada’s economy has considerable slack with unemployment rising in recent months and the lockdown continuing for at least a couple more weeks in the GTA. Moreover, Canada has fallen far behind other countries in the vaccine rollout. But there is no denying that pent-up demand in Canada is high. Not only have home sales been breaking records, but auto sales and anything housing-related–such as Home Depot earning growth–have skyrocketed.

Savings rates are high, and the big banks have reported a surge in deposit growth as consumers squirrel away those savings. Remember, the Roaring Twenties was a response to the 1918 Pandemic, more than anything else.

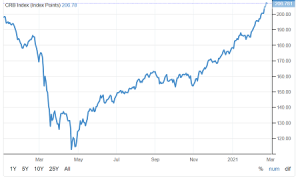

The CRB commodity price index, shown below, is on a tear, and the gains are in every sector except gold and orange juice. That means that new home construction costs are also rising, as home sales remain well above listings.

Bottom Line

It’s time to lock-in mortgage rates. For those in the market, preapprovals are prudent. Rising rates will likely trigger more housing activity in the near-term as those thinking of buying might move off the sidelines, pushing prices higher over the first half of this year.

The surge in interest rates would undoubtedly stall or reverse if we see a third wave of new variant COVID cases in advance of a full rollout of the vaccines in Canada. However, there is enough monetary and fiscal stimulus in global markets, and oil prices are expected to continue to rally sufficiently that an ultimate rise in interest rates cannot be far off. This is indicated by the loonie moving to a near a 3-year high.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres