Don’t be house rich and cash poor!

Allow approximately 32% of your household monthly income before deductions to cover your monthly Mortgage payment (including property taxes, heating costs and half of any maintenance fees).

First Time Home Buyer Mohamed Mahmoud 8 Dec

Don’t be house rich and cash poor!

Allow approximately 32% of your household monthly income before deductions to cover your monthly Mortgage payment (including property taxes, heating costs and half of any maintenance fees).

First Time Home Buyer Mohamed Mahmoud 1 Dec

The ideal down payment for purchasing a home is 20%. However, I know in today’s market that it’s not always possible. Therefore, if you have less than 20%, you must account for default insurance.

Did you know?

If the purchase price is less than $500,000, the minimum down payment is 5%.

If the purchase price is between $500,000 and $999,999, the minimum down payment is 5% of the first $500,000, and 10% of any amount over $500,000.

For properties valued at or over $1M, you must have a minimum down-payment of 20%.

First Time Home Buyer Mohamed Mahmoud 24 Nov

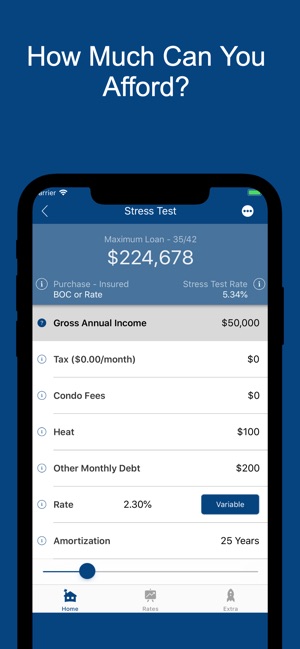

To help determine your budget, download the My Mortgage Toolbox app from the link below.

https://www.dlcapp.ca/app/mohamed-mahmoud?lang=en

This handy tool will help you calculate mortgage payments, affordability, income required to qualify and even estimate your closing costs!

It also allows you to connect directly with me through the app so that I can answer any questions you have right in the palm of your hands!

First Time Home Buyer Mohamed Mahmoud 17 Nov

So, what’s a cash flow budget you ask?

Take into consideration monthly funds that go beyond just your mortgage payment.

Costs to consider:

• Property Taxes

• Home Insurance

• Condo Fees

• Heat

• and more!

Being house rich and cash poor can limit your ability to enjoy not only your home but experience life outside its four walls. The home you can comfortably afford may be dramatically different once you make a cash flow budget. You should always make sure you are comfortable with the monthly fees based on your situation today

CASH FLOW red Rubber Stamp over a white background.

First Time Home Buyer Mohamed Mahmoud 10 Nov

Whenever possible, have an inspection done so that you’re completely informed about what you can’t see behind the walls!

Home inspection form with clipboard and pen.