Did you know? Every 10% increase in payment shaves more than 7 years off the life of a five-year variable mortgage term, so every bit extra matters and can make a difference!

Mortgage Tips Mohamed Mahmoud 30 Nov

Did you know? Every 10% increase in payment shaves more than 7 years off the life of a five-year variable mortgage term, so every bit extra matters and can make a difference!

First Time Home Buyer Mohamed Mahmoud 24 Nov

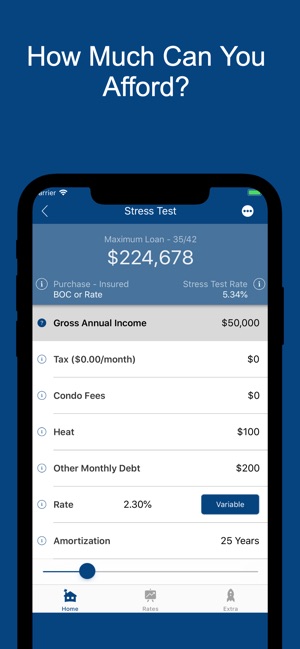

To help determine your budget, download the My Mortgage Toolbox app from the link below.

https://www.dlcapp.ca/app/mohamed-mahmoud?lang=en

This handy tool will help you calculate mortgage payments, affordability, income required to qualify and even estimate your closing costs!

It also allows you to connect directly with me through the app so that I can answer any questions you have right in the palm of your hands!

Mortgage Tips Mohamed Mahmoud 23 Nov

Get a Mortgage to purchase that dream home AND get the funds you need to renovate and make it YOUR home!

This is a purchase plus an improvement Mortgage.

When it comes to home renovations, always do the things that are going to protect your home in the long-term first!

FAQs Mohamed Mahmoud 19 Nov

Create a budget to ensure you have the financial means to afford your mortgage payment, property taxes, strata/condo fees, monthly utility bills and any other household expenses.

First Time Home Buyer Mohamed Mahmoud 17 Nov

So, what’s a cash flow budget you ask?

Take into consideration monthly funds that go beyond just your mortgage payment.

Costs to consider:

• Property Taxes

• Home Insurance

• Condo Fees

• Heat

• and more!

Being house rich and cash poor can limit your ability to enjoy not only your home but experience life outside its four walls. The home you can comfortably afford may be dramatically different once you make a cash flow budget. You should always make sure you are comfortable with the monthly fees based on your situation today

CASH FLOW red Rubber Stamp over a white background.

Mortgage Tips Mohamed Mahmoud 16 Nov

Did you know?

Sticking with your employer while going through the home buying process is crucial. Any changes to your employment or income status can stop or greatly delay the Mortgage process.

FAQs Mohamed Mahmoud 12 Nov

A pre qualification provides you with a ballpark estimate of how much you may be able to afford based on your own self-reporting of your financial situation, in addition to supporting documents.

This helps set a realistic price range for those eager to start shopping the real estate market .

First Time Home Buyer Mohamed Mahmoud 10 Nov

Whenever possible, have an inspection done so that you’re completely informed about what you can’t see behind the walls!

Home inspection form with clipboard and pen.

Mortgage Tips Mohamed Mahmoud 3 Nov

It is a good idea to keep track of when your mortgage term is up. While many lenders send out your renewal letter very close to expiry, shopping for a new term between four and six months before your expiry will ensure you are able to get the best rate for renewal.

Mortgage Topics Mohamed Mahmoud 2 Nov

#Insurance Provider: Once you have confirmed the purchase of your home, you will need to purchase home insurance in order for the home to close. Partnering with a good insurance provider can make all the difference and ensure you receive the right coverage for your contents and space!

Your Mortgage lender will lost likely have this as a condition, and your lawyer will ask for your insurance binder